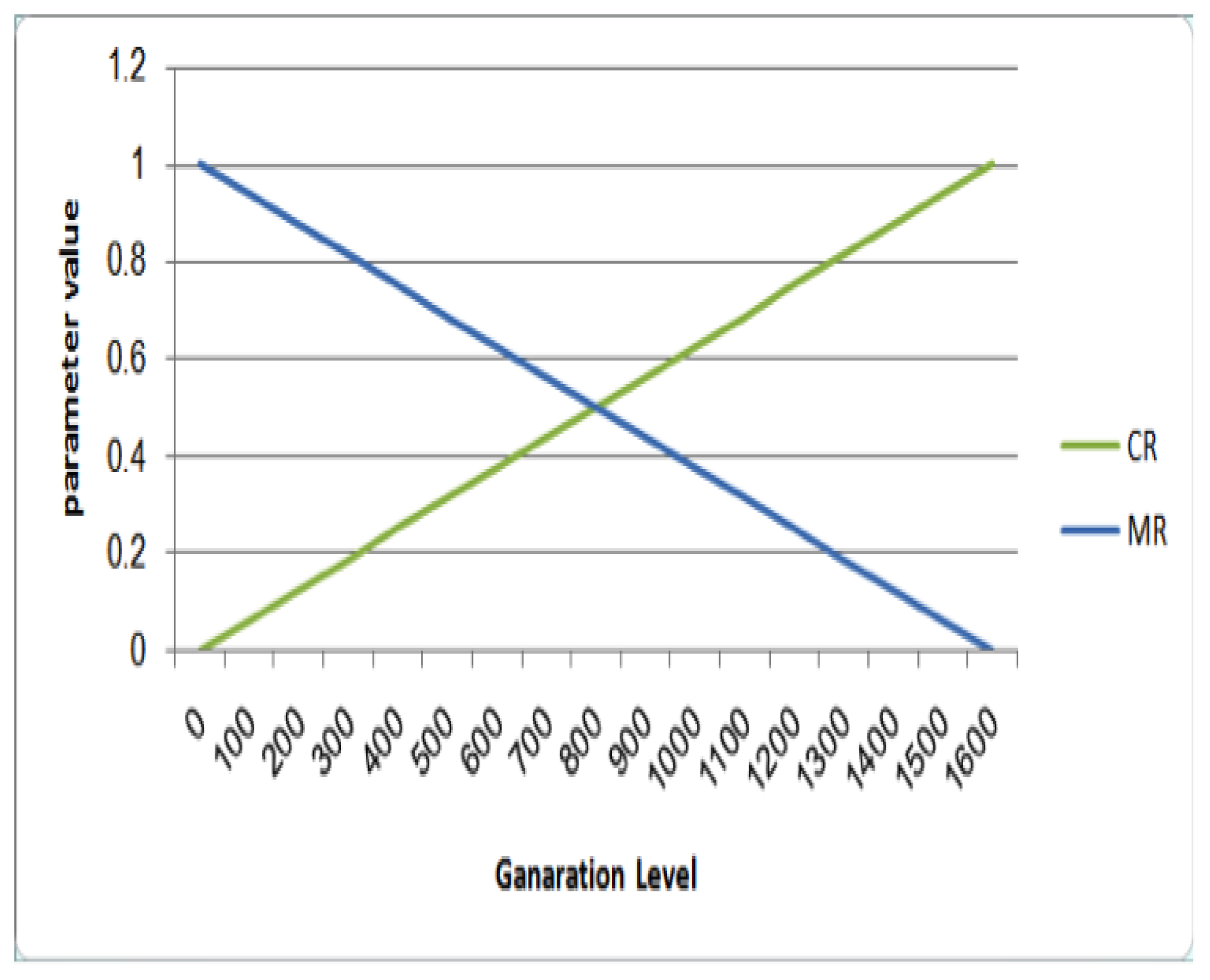

Based Upon the Following Data: Calculate the Crossover Rate.

Based upon the following data. Based upon the following data.

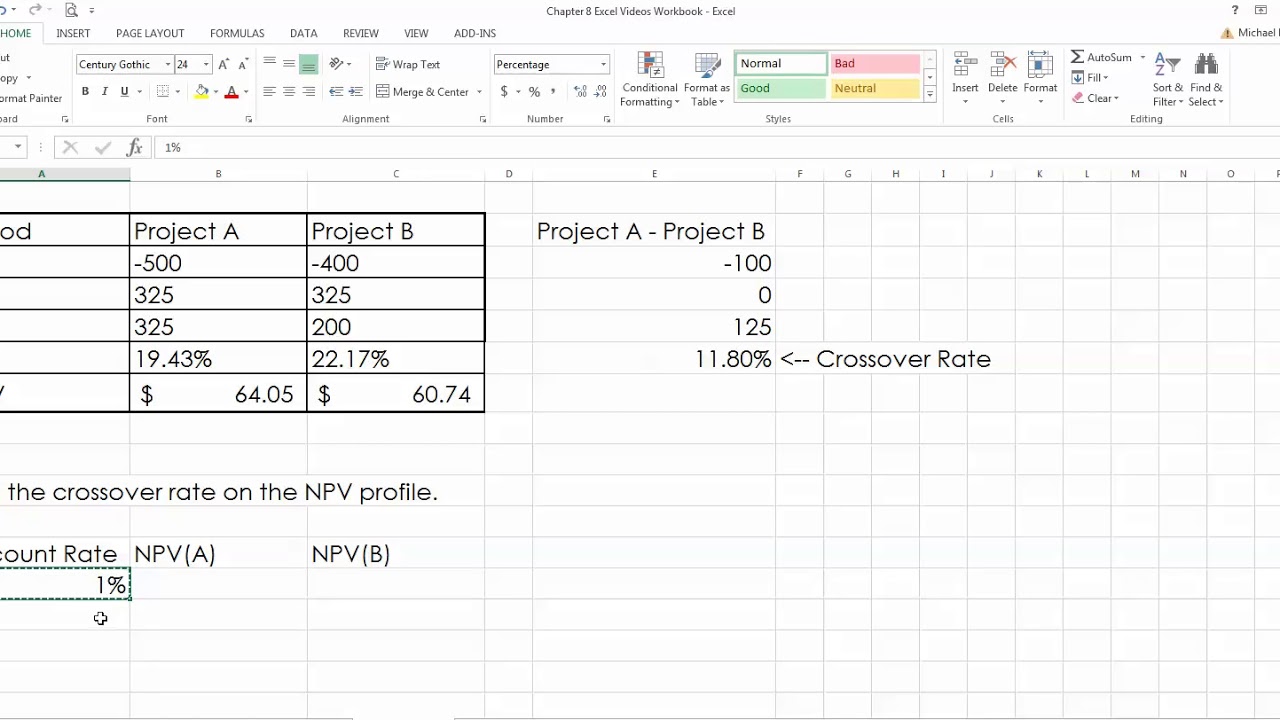

Calculating The Crossover Rate In Excel Youtube

Calculate the Average Accounting Return Net Income.

. Based upon the following data. Based on this information you can determine certain things. Calculate the crossover rate.

Project A Initial Cost - 50000 Year 1 20000 Year 2 25000 Year. To compare the crossover rate to the Internal Rate of Return. Refer to the.

Hospital Rates and Weights. Calculate the crossover rate. Project A Project B Year 0 Year 1 600 700 Year 2 650 800-1000--1200 200 600-700-100 650-800-150 CFO 200 Co1 -100 Co2 -150 IRR CPT 151388.

The All Patient Refined Diagnosis Related Group APR DRG rates and weights the Medicare Severity Diagnosis Related Group MS-DRG weights and rates Enhanced Ambulatory Patient Group EAPG weights and rates and. To calculate the cash flow differences between each project. Based upon the following data.

Answer to Based upon the following data. Calculate the crossover rate. Calculate the Payback Period.

Based upon the following data. Effective January 1 2022 the outpatient base rate for psychiatric hospitals is a provider-specific prospective cost-based rate adjusted by a factor of 8508. Year Year 1 Year 2 Project A -1000 600 650 Project B -1200 700 805 Multiple Choice 625 105 125 165 205.

Project A Project B year 0 -1000 -1200 year1600 700 year 2650 800. Enter your answer in millions rounded to 1 decimal place Net income 650 - 350 - 050 - 030 650 - 350 - 050 250 - 075 175 million Revenues - cash expenses - taxes paid 300 - 075 225 million After tax profit depreciation 175 050 225 millin revenues - cash expenses 050 - tax rate depreciation tax rate 300 070 050 030 225 million. The Discounted Payback Period is.

P4 per share 1annual dividend percentage 1growth rate required rate of return percentage - growth rate P4 330 1194 103 0088 003 11752 P0 per share 1 annual percentage 1RRReturn per share 1 annual percentage2 1RRReturn2 per share 1 annual percentage3 1RRReturn3 per share 1. Project A Initial Cost - 50000 Year 1 20000 Year 2 15000 Year 3 20000. Project A Project B Year 0 Year 1 600 700 Year 2 650 800 Explanation Project A Project B Difference Year 0-1000-1200 200 Year 1 600 700-100 Year 2 650 805-155 NPV A-B 200 -1001R -1551R 2 Note.

Calculate the Discounted Payback Period with a discount rate of 10. Probability of single crossover between vg and pr 0123 corresponds to 123 map units Probability of single crossover between pr and b 0064 corresponds to 64 map units. Calculate the Discounted Payback Period with a discount rate of 10.

Calculate the annual internal rates of return IRR for the following investments time t is in years. Calculate the crossover rate. Finance questions and answers.

What does mutually exclusive mean. Calculate the crossover rate. Year 11500000 Year 21200000 Year 31050000 Year 4-1400000.

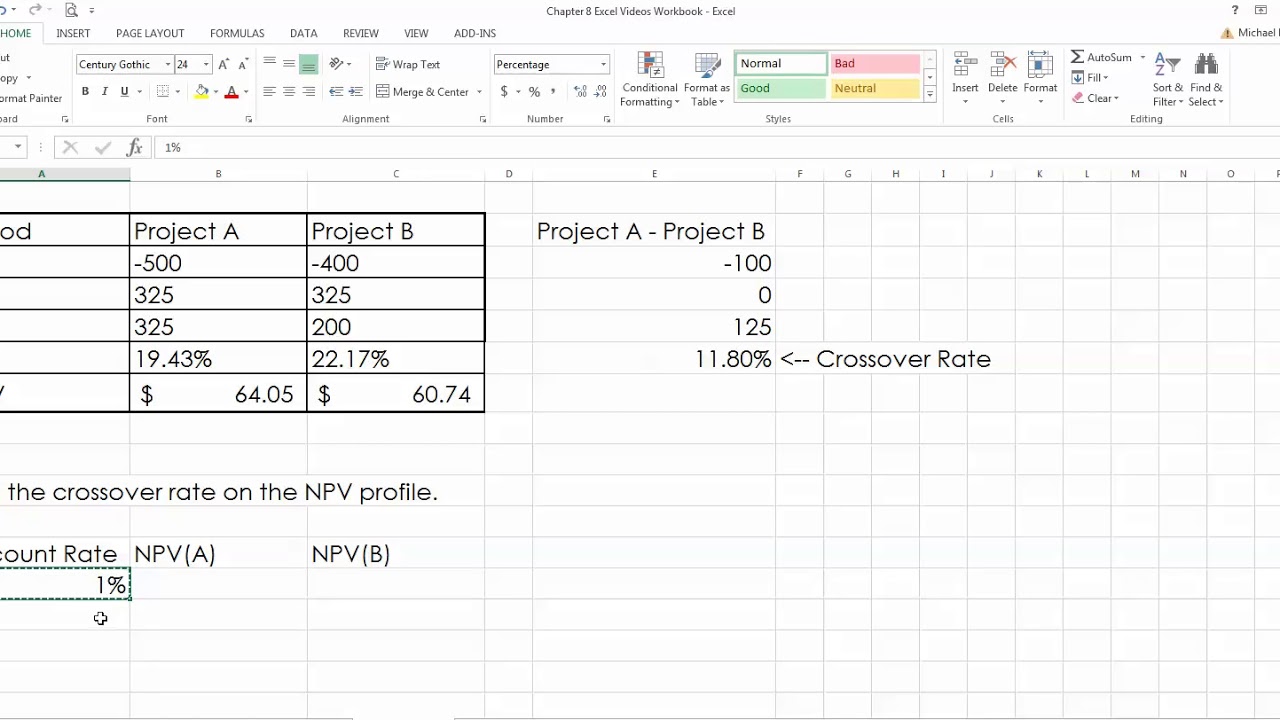

The rest of this work is dedicated to presenting a review of the related works to the subject in Section3 and we present our. Project A Project B Year 1 600 700 Year 2 650 800. To compare the crossover rate to the Net Present Value.

Guidance on Acyclovir for acyclovir topical cream 5 2. Based upon the following data. When utilizing a financial calculator the crossover rate is 165150 The Discounted Payback Period.

Based upon the following data. Organization We start with a review of GA representations in Section2. Calculate the crossover rate.

Assume that the required return on this project is 15 Project A Initial Cost - 150 Year 1 175. Based upon the following data. The probability of a crossover in another region the probability of a double crossover is simply the product of their separate probabilities.

Calculate the crossover rate. Calculate the Net Present Value of the following cash flows. Solved Based upon the following data.

Aluminum fluoride tho chemical formulas from question 2 to write the structures step-by Uou balance the charges. If you know that each parent is heterozygous for both of these traits that is both the mother and the father have one dominant and one recessive allele at both the hair-color gene location locus and the head-shape gene locus then you know that each parent has the genotype PpRr. The DPP is X YZ 3 -1296018 2390547 354 years.

To verify that you have at least five years of data for the calculation. Calculate the crossover rate. The cash flows are 100 at t 1 and 250 at t 3.

The base rate for all other hospitals paid under the EAPG reimbursement methodology was calculated by using an inflation factor to increase the prior rate years base rate and then. From that we can derive the discounted cash flows on a cumulative basis. The DCF for each period is calculated as follows - we multiply the actual cash flows with the PV factor.

Use the Crossover Method to determine the following ionic chemical formula. Based upon the following data. Finance questions and answers.

Project A Initial Cost - 50000 Year 1 20000 Year 2 25000 Year. fifty-fifty crossovermutation ratios and the well-known method that used common ratios with 003 mutation rates and 09 crossover rates. Project B 1200 700 800 Project A 1000 600 650 Year O Year 1 Year 2.

At t 0 the cost is 100. The test and reference products should have an equivalent rate of doxepin release based upon an acceptable in vitro release test IVRT comparing a minimum of one batch each of the test and reference products using an appropriately validated IVRT method. Based upon the following data.

This Portal page was formerly titled Inpatient Outpatient Hospital Rates and Inpatient Hospital Weights.

Calculating The Crossover Rate 8 6 Youtube

Information Free Full Text Choosing Mutation And Crossover Ratios For Genetic Algorithms A Review With A New Dynamic Approach Html

Solved Based Upon The Following Data Calculate The Chegg Com

No comments for "Based Upon the Following Data: Calculate the Crossover Rate."

Post a Comment